By Corey McDonald : shelterforce – excerpt (includes audio track)

What began in earnest during the 2008 financial crisis has been exacerbated by COVID-19: large companies, often backed by powerful private equity firms, swept into the single- and multi-family housing market hoping for a big return on their investment. More than a decade later, they’re not only reaping the rewards — they’re increasing their market share.

“They just bought in bulk,” says Oscar Valdés Viera, a research manager at Americans for Financial Reform. “As people were losing their homes, they were taking advantage of that, and they’re doing that again — they’ve expanded during the pandemic.”…

Two laws specifically address auction sales of distressed properties, or properties that are risk of or have gone through foreclosure. California Senate Bill 1079, which was signed into law in September 2020, modifies the foreclosure auction process to give owner-occupants, tenants, local governments, and housing nonprofits the first right to purchase after a foreclosure sale.

Another bill, the foreclosure intervention housing preservation program, or FIHPP, provides funding in the form of loans or grants for nonprofits, community land trusts, and other eligible buyers to purchase properties available through SB 1079, as well as properties that are delinquent on their mortgage and have gone through a short sale…

The FIHPP process is still being worked out by California’s Department of Housing and Community Development…(more)

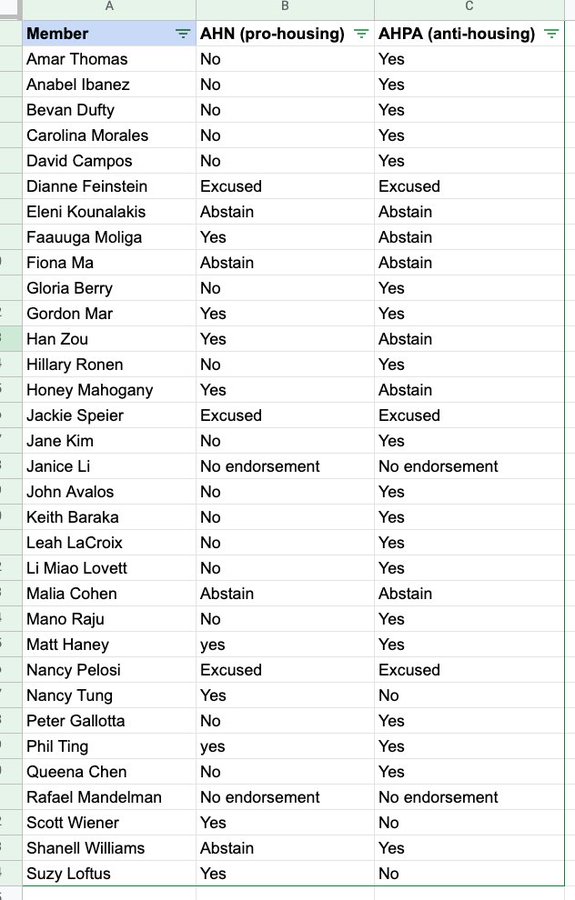

I might be nice to have someone less developer-friendly representing us in Washington to take advantage of federal opportunities to protect homeowners and potential purchasers. Who might that be?

You must be logged in to post a comment.